Malaysia Online Insurance Market Overview:

MarkNtel Advisors recently released a research report focusing on the Malaysia Online Insurance Market for the forecast period 2024–30. Employing robust methodologies in the research section, the report offers valuable insights into sales and revenue forecasts 2024 to 2030. This approach enhances user understanding and supports well-informed decision-making. The report comprehensively addresses significant changes, gap analyses, emerging opportunities, trends, industry dynamics, and competitive challenges using qualitative and quantitative data. To familiarize established businesses and newcomers with the present market scenario, the report offers detailed growth prospects for the industry and concise insights into competitors.

“In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecasts for years 2025 to 2030, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.”

Request For a Free PDF Sample of the Report – https://www.marknteladvisors.com/query/request-sample/malaysia-online-insurance-market.html

Malaysia Online Insurance Market Insight and Analysis:

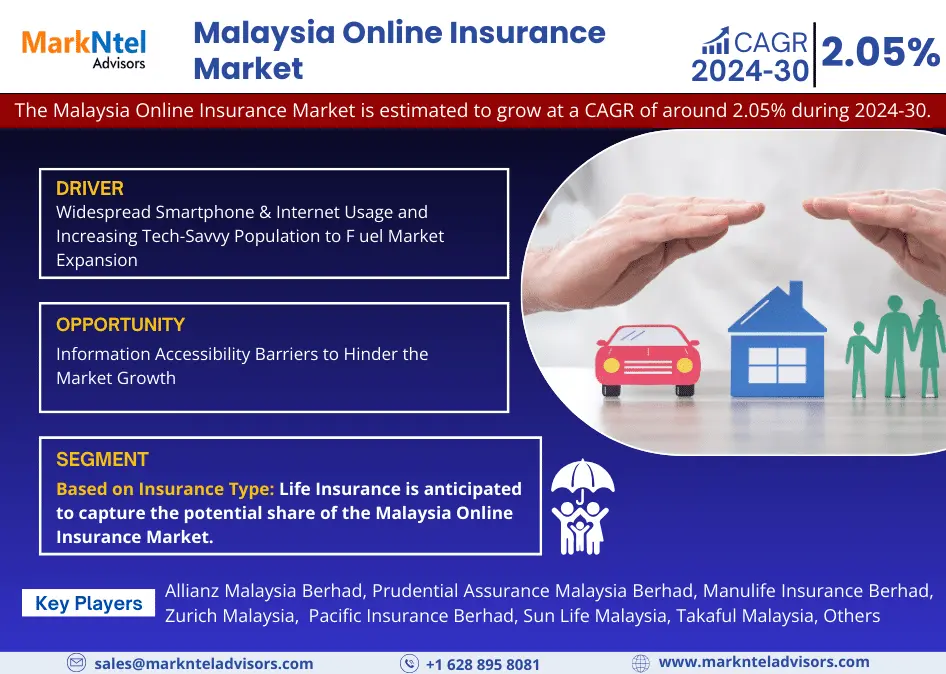

The Malaysia Online Insurance Market is estimated to grow at a CAGR of around 2.05% during the forecast period, i.e., 2024-30. This extensive report offers a detailed examination of the Malaysia Online Insurance market, including segmentation, noteworthy trends, market potential, and challenges. The market is segmented into key categories: By Insurance Type (Life Insurance, Health insurance, Motor Insurance, Home Insurance, Others (Vehicle Insurance, Property Insurance, etc.)), By End User (Individual Consumers, Business Entities, Transport & Logistics Companies, Financial Institutions, Others (Healthcare Providers, Government Entities, etc.)), By Enterprise Size (Large Enterprises, SMEs), Others. The report’s reliability is strengthened by a thorough study and analysis utilizing various statistical methodologies.

Malaysia Online Insurance Market Driver:

Widespread Smartphone & Internet Usage and Increasing Tech-Savvy Population to Fuel Market Expansion – The widespread adoption of smartphones and easy access to the internet has been instrumental in shaping the Malaysia Online Insurance Market. The younger demographic, particularly Malaysians, is becoming more connected, turning online platforms into a convenient channel for insurance transactions and driving market growth. Additionally, the country’s tech-savvy population, comfortable with digital tools and online transactions, has played a crucial role in the success of online insurance platforms. This inclination towards embracing technology has further heightened the demand for online insurance, contributing to the market’s upward trajectory.

Browse Full Report With TOC and Latest Market Scope – https://www.marknteladvisors.com/research-library/malaysia-online-insurance-market.html

Analysis of Malaysia Online Insurance Market leading key players:

A thorough examination of the competitive landscape of the Malaysia Online Insurance Market involves a comprehensive analysis of its key competitors. This analysis delves deep into each company’s profile, financial achievements, market presence, potential, Research and Development (R&D) expenditures, recent strategic initiatives in the market, footprint, strengths, weaknesses, and market dominance. The information provided offers a comprehensive overview of the leading market players, including Allianz Malaysia Berhad, Prudential Assurance Malaysia Berhad, AIA Bhd., Manulife Insurance Berhad, Zurich Malaysia, Hong Leong Assurance Berhad, Pacific Insurance Berhad, Sun Life Malaysia, Takaful Malaysia, Generali Insurance Malaysia Berhad, Great Eastern Life Insurance (Malaysia) Berhad, and Others (Etiqua Insurance Berhad, AM Assurance, etc.)

Conclusion:

The report is designed to offer customized solutions that precisely address customers’ unique needs. By thoroughly understanding key growth drivers, businesses can formulate effective strategies, allowing them to navigate the dynamic landscape of any market successfully.

Request Customization – https://www.marknteladvisors.com/query/request-customization/malaysia-online-insurance-market.html

The Malaysia Online Insurance Market report addresses the following concern:

- The Malaysia Online Insurance Market report explores the influence of key trends on market share within the primary segments.

- What are the leading market trends that propel the expansion of the Malaysia Online Insurance market?

- What are the projected CAGR, market size, and growth rate for the Malaysia Online Insurance Market in the upcoming years?

- What are the key players in the Malaysia Online Insurance market, and what strategies are they implementing?

- What factors, such as industry trends, drivers, and challenges, are contributing to the growth of the Malaysia Online Insurance market?

Read More:

- https://reporttok.blogspot.com/2024/11/global-single-use-system-in-biopharma.html

- https://reporttok.blogspot.com/2024/11/armored-vehicles-market-growth-report.html

- https://reporttok.blogspot.com/2024/11/telemedicine-market-growth-report.html

- https://reporttok.blogspot.com/2024/11/automotive-lubricants-market-growth.html

- https://reporttok.blogspot.com/2024/11/global-artificial-intelligence-market.html

About Us:

We are a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

Contact Us:

MarkNtel Advisors

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Address Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

Email: sales@marknteladvisors.com

Tel No: +1 628 895 8081, +91 120 4278433